State Farm auto insurance plans offer some of the most comprehensive coverage options available in the market today. Whether you're a new driver or a seasoned one, understanding these plans is essential to protect yourself and your vehicle. This article will delve into everything you need to know about State Farm's offerings, helping you make informed decisions about your insurance needs.

When it comes to auto insurance, choosing the right plan can save you both money and headaches in the long run. State Farm has established itself as a leader in the insurance industry, providing reliable and affordable coverage to millions of customers across the United States. Their commitment to quality service and customer satisfaction makes them a top choice for many drivers.

As you explore State Farm auto insurance plans, it's important to consider factors such as coverage types, discounts, and additional benefits. This article will guide you through each aspect, ensuring you have all the information necessary to select the best plan for your situation. Let's dive in and uncover the details of State Farm's offerings.

Read also:Madden Nfl 24 Release Date Ps5 Everything You Need To Know

Table of Contents:

- Biography of State Farm

- Overview of State Farm Auto Insurance Plans

- Coverage Options Available

- Discounts and Savings Opportunities

- The Claims Process Explained

- State Farm Customer Service

- Reviews and Ratings

- State Farm vs. Competitors

- Frequently Asked Questions

- Conclusion

Biography of State Farm

State Farm Mutual Automobile Insurance Company was founded in 1922 by George J. Mecherle. Headquartered in Bloomington, Illinois, the company has grown to become one of the largest auto insurance providers in the United States. Below is a brief overview of State Farm's history and key milestones:

Key Facts About State Farm

| Founded | 1922 |

|---|---|

| Founder | George J. Mecherle |

| Headquarters | Bloomington, Illinois |

| Revenue | $81.2 billion (2022) |

| Employees | More than 53,000 |

State Farm's commitment to innovation and customer service has earned it a reputation as a trusted insurance provider. With over 19,000 agents and representatives nationwide, State Farm continues to expand its reach and improve its offerings.

Overview of State Farm Auto Insurance Plans

State Farm auto insurance plans are designed to cater to a wide range of customer needs. From basic liability coverage to comprehensive protection, these plans provide flexibility and affordability. Understanding the basics of State Farm's offerings is the first step in choosing the right plan for you.

Types of Coverage Offered

State Farm provides several types of coverage to ensure your vehicle and finances are protected. Below are some of the most common coverage options:

- Liability Coverage: Protects you from legal responsibility for injuries or property damage caused to others.

- Collision Coverage: Covers damage to your vehicle resulting from a collision with another object or vehicle.

- Comprehensive Coverage: Protects your vehicle against non-collision incidents such as theft, vandalism, or natural disasters.

Each plan is customizable, allowing you to tailor your coverage to fit your specific needs and budget.

Read also:Delaware County Title Office A Comprehensive Guide To Property Transactions

Coverage Options Available

State Farm offers a variety of coverage options beyond the basics. These additional protections can provide peace of mind and safeguard against unexpected events. Let's take a closer look at some of the key coverage options:

Uninsured/Underinsured Motorist Coverage

This coverage protects you in the event of an accident involving a driver who does not have sufficient insurance. It ensures you are compensated for damages or injuries even if the other party is at fault but lacks adequate coverage.

Rental Reimbursement Coverage

Rental reimbursement coverage helps pay for a rental car if your vehicle is damaged and needs repairs. This can be especially useful if you rely on your car for daily transportation.

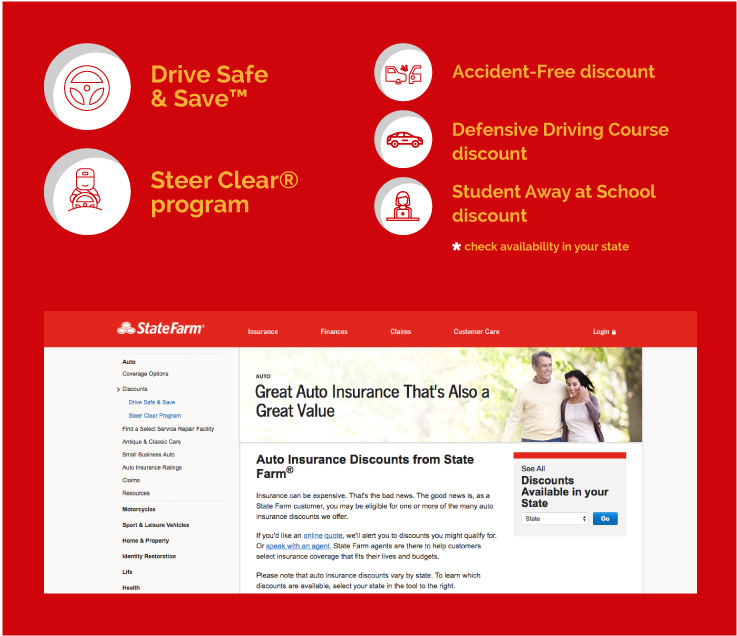

Discounts and Savings Opportunities

State Farm offers numerous discounts to help you save money on your auto insurance premiums. By taking advantage of these discounts, you can reduce your costs without compromising on coverage. Here are some of the most popular discounts:

- Safe Driver Discount: Rewarding drivers with a clean driving record.

- Multicar Discount: Offering savings when insuring multiple vehicles under the same policy.

- Good Student Discount: Providing reduced rates for students who maintain good grades.

Be sure to ask your State Farm agent about available discounts to maximize your savings.

The Claims Process Explained

Understanding the claims process is crucial for any driver. State Farm strives to make this process as simple and efficient as possible. Here's a step-by-step guide to filing a claim with State Farm:

Step 1: Report the Incident

Contact State Farm immediately after an accident to report the incident. You can do this through their mobile app, website, or by calling their customer service number.

Step 2: Provide Documentation

Gather all necessary documentation, including police reports, photos of the damage, and contact information for any involved parties. Submitting this information promptly can speed up the claims process.

State Farm Customer Service

State Farm is renowned for its exceptional customer service. Their team of agents and representatives is dedicated to assisting customers with their insurance needs. Whether you need help filing a claim or have questions about your policy, State Farm's customer service is available to assist you.

Accessibility and Support

State Farm provides multiple channels for customer support, including phone, email, and in-person assistance at local offices. This accessibility ensures that customers can receive help whenever and wherever they need it.

Reviews and Ratings

Customer reviews and ratings can provide valuable insights into the quality of an insurance provider's services. State Farm consistently receives high marks for its customer service, coverage options, and claims handling. According to J.D. Power's 2023 U.S. Auto Claims Satisfaction Study, State Farm ranks among the top performers in customer satisfaction.

Testimonials

Many State Farm customers have shared positive experiences, highlighting the company's responsiveness and reliability. For example, one satisfied customer stated, "State Farm made the claims process so easy. They were there for me every step of the way."

State Farm vs. Competitors

When comparing State Farm to other auto insurance providers, it's important to consider factors such as coverage, pricing, and customer service. State Farm's competitive rates and extensive network of agents set it apart from its competitors. Additionally, their commitment to innovation ensures they remain at the forefront of the industry.

Competitive Edge

State Farm's use of cutting-edge technology, such as their mobile app and online tools, enhances the customer experience. These features allow customers to manage their policies, file claims, and access resources with ease.

Frequently Asked Questions

Q: How do I get a quote for State Farm auto insurance?

A: You can obtain a quote by visiting State Farm's website, contacting a local agent, or using their mobile app. Providing accurate information about your vehicle and driving history will help ensure an accurate quote.

Q: What factors affect my premium?

A: Several factors influence your premium, including your driving record, vehicle type, location, and chosen coverage options. Maintaining a safe driving record and taking advantage of discounts can help lower your costs.

Conclusion

In conclusion, State Farm auto insurance plans offer comprehensive coverage options, competitive pricing, and exceptional customer service. By understanding the various coverage types, discounts, and claims process, you can make an informed decision about your insurance needs. We encourage you to explore State Farm's offerings and consult with a local agent to find the best plan for you.

Don't hesitate to leave a comment or share this article with others who may benefit from the information. For more insights into auto insurance and related topics, be sure to explore our other articles on the site.