Investing in healthcare stocks has become a popular choice for investors seeking long-term growth and stability in their portfolios. The healthcare sector offers a wide range of opportunities, from pharmaceutical companies to medical technology firms. However, understanding how to navigate this complex industry is crucial to making informed decisions.

The healthcare sector continues to evolve, driven by innovation, aging populations, and increasing demand for medical services. Whether you're a beginner or an experienced investor, learning how to invest in healthcare stocks can help you capitalize on this growing market. In this guide, we will explore the key steps, strategies, and considerations to help you make smarter investment choices.

By the end of this article, you will gain valuable insights into the healthcare industry and understand the best practices for selecting healthcare stocks. Let's dive in and discover how you can maximize your returns while minimizing risks.

Read also:Amc Theatres Merchants Crossing 16 Your Ultimate Guide To Entertainment

Table of Contents

- Understanding the Healthcare Sector

- Benefits of Investing in Healthcare Stocks

- Types of Healthcare Stocks

- How to Research Healthcare Stocks

- Investment Strategies for Healthcare Stocks

- Understanding Risks in the Healthcare Sector

- Long-Term Growth Opportunities

- Tips for Beginners

- Tools and Resources for Investors

- Conclusion

Understanding the Healthcare Sector

The healthcare sector is one of the largest and most dynamic industries globally, encompassing various sub-sectors such as pharmaceuticals, biotechnology, medical devices, and healthcare services. This sector plays a vital role in improving global health and quality of life.

Key Drivers of Growth

Several factors contribute to the growth of the healthcare sector:

- Aging population: As life expectancy increases, the demand for healthcare services rises.

- Technological advancements: Innovations in medical technology and treatments drive growth.

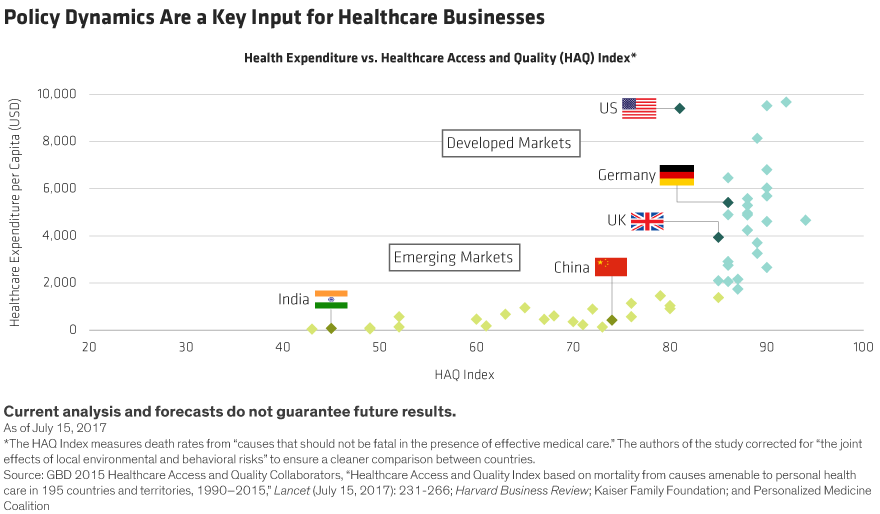

- Government policies: Regulatory changes and healthcare reforms impact the industry significantly.

Understanding these drivers is essential for investors looking to capitalize on the healthcare market's potential.

Benefits of Investing in Healthcare Stocks

Investing in healthcare stocks offers numerous advantages, making it an attractive option for both novice and seasoned investors.

1. Defensive Nature

Healthcare stocks are often considered defensive investments because demand for medical products and services remains relatively stable, even during economic downturns.

2. High Growth Potential

The healthcare sector is expected to grow significantly in the coming years, driven by advancements in medical technology and increasing healthcare spending worldwide.

Read also:Civil Coffee Highland Park Your Ultimate Coffee Destination

Types of Healthcare Stocks

The healthcare sector comprises several sub-sectors, each offering unique investment opportunities. Below are some of the main categories:

1. Pharmaceutical Companies

These companies develop, manufacture, and market prescription drugs. Key players include Pfizer, Johnson & Johnson, and Merck.

2. Biotechnology Firms

Biotech companies focus on innovative treatments and therapies, often targeting rare diseases and unmet medical needs.

3. Medical Device Manufacturers

These firms produce medical equipment and devices used in diagnosis, treatment, and monitoring of health conditions.

4. Healthcare Services Providers

Companies offering healthcare services, such as hospitals, clinics, and insurance providers, also play a significant role in the sector.

How to Research Healthcare Stocks

Conducting thorough research is crucial when selecting healthcare stocks for your portfolio. Here are some key steps to follow:

1. Analyze Financial Performance

Evaluate the company's financial statements, including revenue growth, profit margins, and cash flow. Look for consistent performance and strong financial health.

2. Assess Competitive Position

Understand the company's competitive advantage, market share, and ability to innovate. Companies with a strong pipeline of new products or treatments are more likely to succeed.

3. Review Management Team

A skilled and experienced management team is essential for driving the company's success. Research the background and track record of key executives.

Investment Strategies for Healthcare Stocks

To maximize your returns, consider the following investment strategies:

1. Diversification

Spread your investments across different sub-sectors and companies to reduce risk. Diversification helps protect your portfolio from sector-specific downturns.

2. Long-Term Focus

Healthcare stocks often require a long-term investment horizon due to the time-intensive nature of drug development and regulatory approval processes.

Understanding Risks in the Healthcare Sector

While healthcare stocks offer significant growth potential, they also come with certain risks:

1. Regulatory Risks

Healthcare companies must comply with strict regulations, which can delay product launches or increase costs.

2. Development Risks

Drug development is a lengthy and uncertain process, with many candidates failing clinical trials or facing unexpected challenges.

Long-Term Growth Opportunities

The healthcare sector presents numerous opportunities for long-term growth, driven by:

1. Global Health Trends

Increasing awareness of preventive care and wellness is driving demand for healthcare services and products.

2. Emerging Markets

Expanding healthcare infrastructure in emerging markets creates new opportunities for companies to expand their reach.

Tips for Beginners

If you're new to investing in healthcare stocks, here are some tips to help you get started:

- Start small and gradually build your portfolio.

- Focus on established companies with proven track records.

- Stay informed about industry trends and developments.

Tools and Resources for Investors

Various tools and resources can aid investors in analyzing healthcare stocks:

1. Stock Screeners

Use stock screeners to filter companies based on specific criteria, such as market capitalization or revenue growth.

2. Industry Reports

Consult industry reports and white papers for in-depth analysis of market trends and forecasts.

Conclusion

Investing in healthcare stocks can be a rewarding endeavor, offering both stability and growth potential. By understanding the sector's dynamics, conducting thorough research, and employing sound investment strategies, you can build a successful healthcare stock portfolio.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our website for more insights into the world of investing.

Data Sources and References:

- World Health Organization (WHO)

- U.S. Food and Drug Administration (FDA)

- Statista

Remember, investing in healthcare stocks requires patience and diligence. Stay informed, remain disciplined, and always seek professional advice if needed.