State Farm auto insurance is one of the most trusted and popular choices for drivers in the United States. With its extensive network, competitive pricing, and exceptional customer service, it has established itself as a leader in the insurance industry. If you're considering purchasing car insurance, understanding State Farm's offerings is crucial to making an informed decision.

When it comes to protecting your vehicle and ensuring peace of mind on the road, choosing the right insurance provider is essential. State Farm stands out for its comprehensive coverage options, personalized service, and commitment to customer satisfaction. Whether you're a new driver or a seasoned one, State Farm provides tailored solutions to meet your specific needs.

This article will delve into the details of State Farm auto insurance, covering everything from coverage options and pricing to customer reviews and expert insights. By the end of this guide, you'll have a clear understanding of why State Farm is a top choice for many drivers and how it can benefit you.

Read also:Moody Blues I Love You A Timeless Journey Through Love And Melody

Table of Contents

- Introduction to State Farm

- Types of Coverage Offered

- Pricing and Discounts

- Customer Service

- Claims Process

- State Farm Reviews

- State Farm vs. Competitors

- State Farm Mobile App

- Frequently Asked Questions

- Conclusion

Introduction to State Farm

State Farm Mutual Automobile Insurance Company was founded in 1922 and has since grown into one of the largest insurance providers in the United States. Headquartered in Bloomington, Illinois, State Farm offers a wide range of insurance products, including auto, home, life, and health insurance. Its mission is to help people manage risk and protect their financial well-being.

History of State Farm

State Farm's journey began with a simple idea: to provide affordable car insurance to farmers. Over the decades, the company expanded its services and now serves millions of customers across the U.S. and Canada. State Farm's commitment to innovation and customer service has been a key factor in its success.

State Farm's Market Presence

With over 19,000 agents and more than 83 million policies in force, State Farm holds a significant share of the insurance market. Its extensive network ensures that customers can easily access services and support whenever they need it.

Types of Coverage Offered

State Farm offers a variety of auto insurance coverage options to meet the diverse needs of its customers. Understanding these options is essential to selecting the right policy for your vehicle.

Liability Coverage

Liability coverage is a legal requirement in most states and protects you from financial liability in the event of an accident. State Farm provides both bodily injury and property damage liability coverage.

Collision and Comprehensive Coverage

- Collision Coverage: Covers damages to your vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle against non-collision incidents such as theft, vandalism, and natural disasters.

Additional Coverage Options

State Farm also offers additional coverage options like rental reimbursement, roadside assistance, and uninsured/underinsured motorist coverage. These options provide extra protection and peace of mind for drivers.

Read also:High Energy Rock Songs The Ultimate Guide To Boost Your Mood

Pricing and Discounts

The cost of State Farm auto insurance varies based on several factors, including your driving record, vehicle type, and coverage options. However, State Farm offers various discounts to help you save money on your premium.

Factors Affecting Pricing

- Driving history

- Vehicle type

- Coverage level

- Location

Available Discounts

State Farm provides numerous discounts, such as safe driver discounts, multi-policy discounts, and discounts for bundling multiple insurance products. These discounts can significantly reduce your premium.

Customer Service

State Farm prides itself on its exceptional customer service. Whether you need assistance with policy changes, claims, or general inquiries, State Farm's team is dedicated to providing timely and helpful support.

State Farm Agents

State Farm agents are trained professionals who offer personalized service and guidance. They can help you understand your policy options and ensure you have the right coverage for your needs.

24/7 Support

State Farm offers round-the-clock support through its customer service hotline and mobile app. This ensures that you can get help whenever you need it, even outside of regular business hours.

Claims Process

Filing a claim with State Farm is a straightforward process. The company provides multiple channels for submitting claims, including online, phone, and in-person at a local office.

Steps to File a Claim

- Contact State Farm to report the incident.

- Provide details about the accident or incident.

- Work with a claims adjuster to assess damages and determine coverage.

- Receive payment or reimbursement based on your policy terms.

Claim Settlement Options

State Farm offers flexible settlement options, including direct deposits and checks, to ensure you receive your claim payment quickly and conveniently.

State Farm Reviews

Customer reviews play a crucial role in evaluating the quality of an insurance provider. State Farm consistently receives positive feedback for its coverage options, pricing, and customer service.

Customer Satisfaction

Many customers praise State Farm for its responsive customer service and efficient claims process. The company's commitment to transparency and fairness is evident in its reviews.

Areas for Improvement

While State Farm receives high praise, some customers have noted areas for improvement, such as premium increases after claims and occasional delays in processing.

State Farm vs. Competitors

When comparing State Farm to other insurance providers, it's important to consider factors like coverage, pricing, and customer service. State Farm often stands out due to its extensive network and personalized approach.

Key Competitors

- Allstate

- Geico

- Progressive

Why Choose State Farm?

State Farm's combination of competitive pricing, comprehensive coverage, and excellent customer service makes it a top choice for many drivers. Its long-standing reputation and commitment to innovation further solidify its position in the industry.

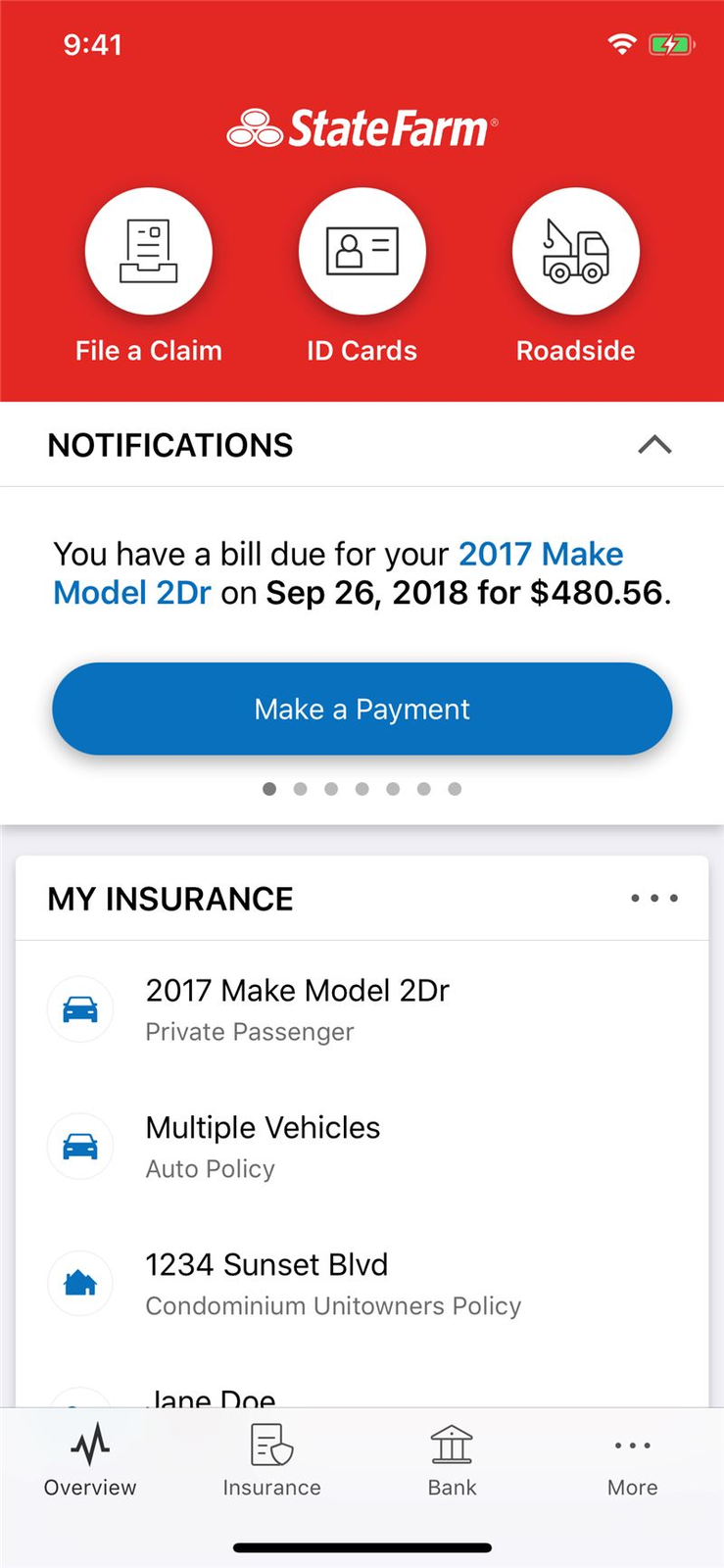

State Farm Mobile App

The State Farm mobile app is a convenient tool for managing your insurance policy on the go. It offers features like policy management, claims submission, and roadside assistance at your fingertips.

App Features

- View and manage your policy details

- Submit claims with ease

- Access roadside assistance services

User Experience

Users appreciate the app's intuitive interface and reliable performance. It simplifies many tasks that previously required a phone call or in-person visit.

Frequently Asked Questions

How Does State Farm Determine Premiums?

State Farm uses a combination of factors, including driving history, vehicle type, and coverage level, to determine premiums. Safe driving habits and bundling policies can help reduce costs.

What Happens If I Miss a Payment?

If you miss a payment, State Farm may place your policy in a grace period. During this time, you can make the payment without penalty. If the payment is not made within the grace period, your policy may lapse.

Can I Change My Policy Online?

Yes, you can make changes to your policy through the State Farm website or mobile app. Simply log in to your account and update your preferences as needed.

Conclusion

State Farm auto insurance offers a comprehensive range of coverage options, competitive pricing, and exceptional customer service. Its commitment to innovation and customer satisfaction has made it a trusted choice for millions of drivers across the United States.

We encourage you to explore State Farm's offerings and consider how they can benefit you. For more information, visit their official website or contact a local State Farm agent. Don't forget to leave a comment or share this article if you found it helpful!