Bank transit ABA numbers play a crucial role in the banking industry, especially when it comes to transferring funds between banks. These numbers ensure that transactions are accurate and secure. Understanding what a bank transit ABA number is and how it works is essential for anyone who deals with banking operations or financial transfers.

For individuals and businesses alike, knowing the specifics of bank transit ABA numbers can help streamline financial processes. This article aims to provide a detailed overview of what these numbers are, their significance, and how they function within the banking ecosystem.

In today’s digital age, where transactions are increasingly done online, having a clear understanding of bank transit ABA numbers can prevent errors and enhance the efficiency of financial operations. Let’s dive deeper into this essential banking concept.

Read also:Centaur From Percy Jackson Exploring The Mythical Creatures Role In The Series

Table of Contents

- What is a Bank Transit ABA Number?

- History and Evolution of ABA Numbers

- How Bank Transit ABA Numbers Work

- Types of ABA Routing Numbers

- Finding Your Bank Transit ABA Number

- Common Uses of ABA Numbers

- Differences Between ABA and ACH Numbers

- Security and Privacy Concerns with ABA Numbers

- ABA Numbers and International Transactions

- Conclusion and Next Steps

What is a Bank Transit ABA Number?

A bank transit ABA number, also known as a routing transit number (RTN), is a nine-digit code used to identify financial institutions in the United States. It serves as a unique identifier for banks and credit unions, ensuring that funds are routed to the correct institution during transactions.

This number is essential for domestic transactions, such as direct deposits, bill payments, and wire transfers. The ABA number was originally developed by the American Bankers Association (ABA) in 1910 to facilitate efficient and secure banking operations.

Key Features:

- Nine-digit code

- Unique to each financial institution

- Used for domestic transactions

History and Evolution of ABA Numbers

Origins of ABA Numbers

The concept of ABA numbers dates back to 1910 when the American Bankers Association introduced them to standardize banking processes. Initially, these numbers were used to streamline check processing, but their application has expanded significantly over the years.

Modern Applications

Today, ABA numbers are used not only for check processing but also for electronic transactions such as ACH transfers and wire transfers. The evolution of technology has made these numbers more versatile and integral to the modern banking system.

How Bank Transit ABA Numbers Work

Bank transit ABA numbers function as a unique identifier for financial institutions, ensuring that transactions are routed correctly. When a transaction is initiated, the ABA number is used to direct the funds to the appropriate bank or credit union.

Read also:The Oldest Living Animal On Earth Unveiling The Mysteries Of Eternal Life

Steps in the Process:

- Identification of the receiving bank using the ABA number

- Verification of the account details

- Execution of the transaction

Types of ABA Routing Numbers

Standard Routing Numbers

Standard routing numbers are used for most domestic transactions, including check processing and ACH transfers. These numbers are assigned based on the location of the financial institution.

Wire Transfer Routing Numbers

Wire transfer routing numbers are specifically designed for wire transfers and may differ from standard routing numbers. They ensure that large sums of money are transferred securely and efficiently.

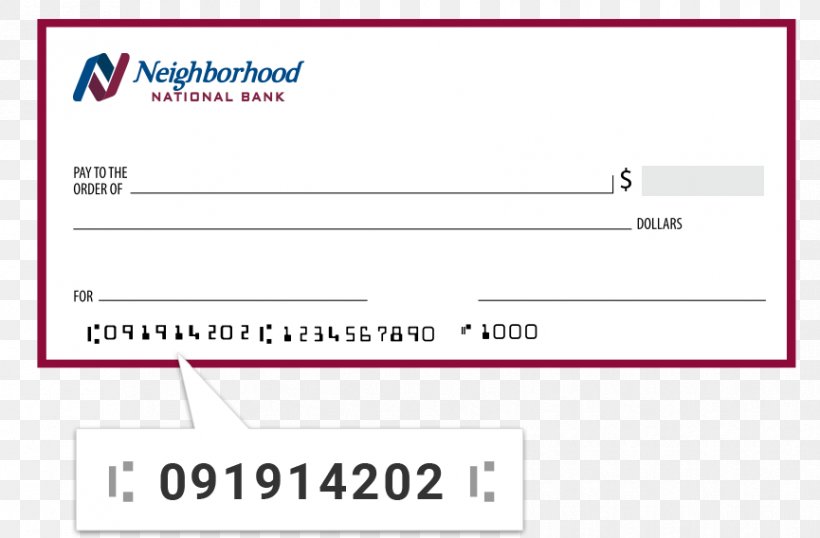

Finding Your Bank Transit ABA Number

Locating your bank transit ABA number is straightforward. It can typically be found in the following places:

- At the bottom of your checks

- On your bank’s official website

- Through your bank’s customer service

For those who do not have physical checks, accessing the ABA number online is a convenient alternative.

Common Uses of ABA Numbers

ABA numbers are utilized in various financial transactions, including:

- Direct deposits

- Bill payments

- Wire transfers

- ACH transfers

Each of these uses ensures that funds are transferred accurately and securely, minimizing the risk of errors.

Differences Between ABA and ACH Numbers

While ABA and ACH numbers are often used interchangeably, they serve slightly different purposes. ABA numbers are primarily used for routing transactions, while ACH numbers are used specifically for electronic transfers.

Key Differences:

- ABA numbers: Used for routing transactions

- ACH numbers: Used for electronic transfers

Security and Privacy Concerns with ABA Numbers

While ABA numbers are essential for banking operations, they can also pose security risks if mishandled. It is crucial to keep your ABA number confidential to prevent unauthorized access to your accounts.

Best Practices for Security:

- Do not share your ABA number unnecessarily

- Use secure methods for transmitting sensitive information

- Monitor your accounts regularly for suspicious activity

ABA Numbers and International Transactions

ABA numbers are primarily used for domestic transactions within the United States. For international transactions, other identifiers such as SWIFT codes are typically used. However, ABA numbers can still play a role in certain cross-border transactions involving U.S. banks.

Understanding the differences between ABA numbers and international identifiers is essential for anyone engaging in global financial activities.

Conclusion and Next Steps

In conclusion, bank transit ABA numbers are a critical component of the banking system, ensuring accurate and secure transactions. By understanding their purpose and functionality, individuals and businesses can optimize their financial operations and minimize errors.

Key Takeaways:

- ABA numbers are nine-digit codes used to identify financial institutions

- They are essential for domestic transactions, including direct deposits and wire transfers

- Security measures should be taken to protect ABA numbers and prevent unauthorized access

We encourage you to share this article with others who may benefit from understanding bank transit ABA numbers. Additionally, feel free to explore more resources on our website for further insights into financial topics.

For more information on ABA numbers and related banking concepts, refer to trusted sources such as the American Bankers Association and the Federal Reserve.